CASE STUDY

How Educators Credit Union Is Reaching Its Next Generation of Members

The Challenge

Educators Credit Union isn’t just in the business of finance; they’re in the business of uplifting the communities they serve. For decades, their financial education efforts have included classroom visits, workshops, and campus branches across Wisconsin.

But there was one big challenge: time. With limited interaction windows in schools and community events, the team needed a “leave-behind” tool, something that would empower students to keep learning long after the session ended.

The Solution

After discovering Zogo in a CU Times article, the Educators team saw a unique opportunity: gamified financial education that rewarded learning. Zogo’s white-label app solution turned abstract financial concepts into interactive lessons with quizzes, trivia, and real rewards - built specifically to engage a younger audience.

The team first tested the experience by launching Zogo internally. This internal rollout provided vital user feedback, more than 75% of their staff logged on, validating both the platform's intuitive design and its ability to engage a diverse, younger, and tech-savvy user base. By leveraging these insights, Educators CU strategically positioned Zogo at the core of their youth initiatives.

The Launch

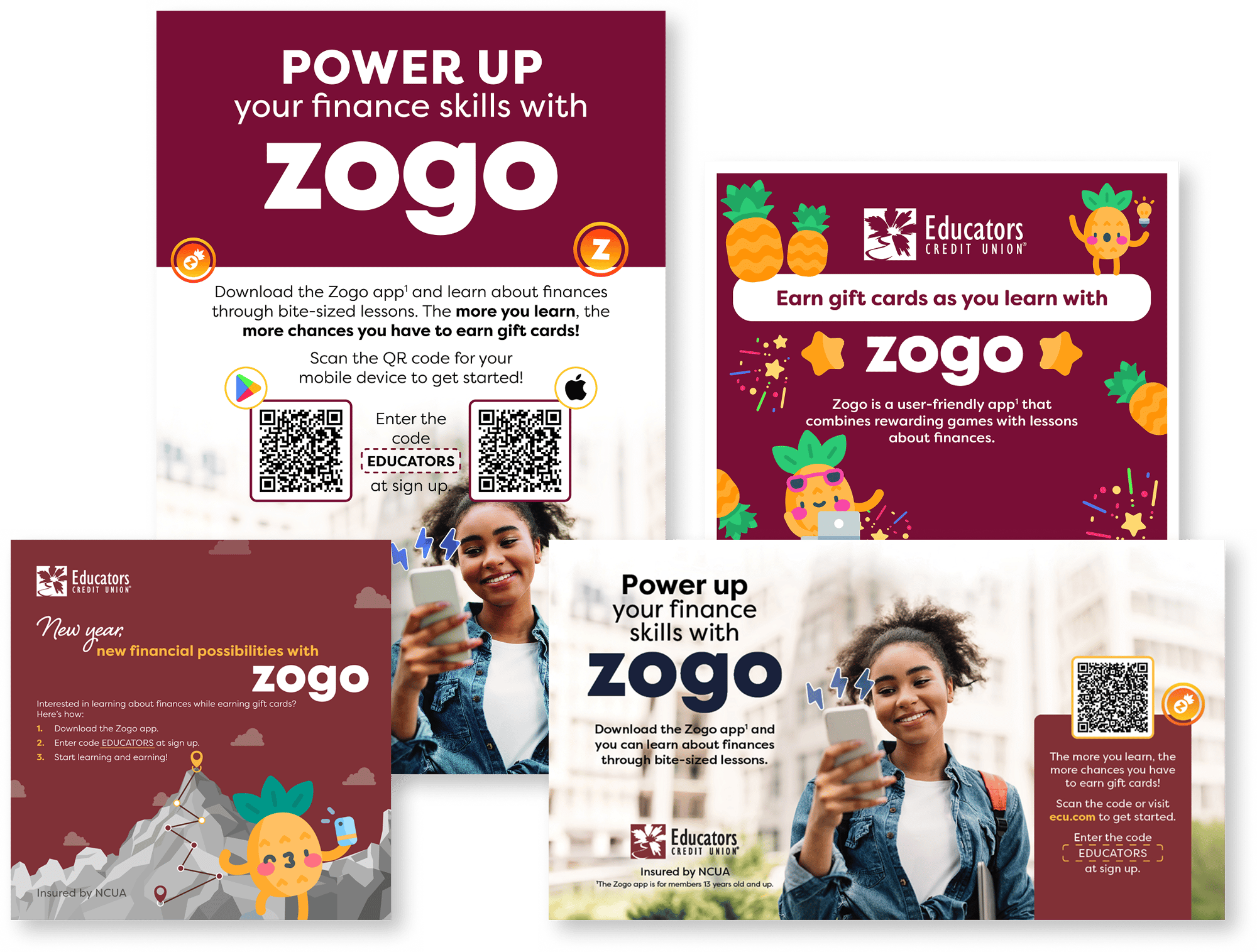

Educators CU rolled out Zogo across multiple touchpoints:

-

High school branches and 'Reality Check Day' events

-

Lobby banners, QR codes, and monthly newsletters

-

Ongoing social media and sign-up campaigns

They also used Zogo's white-label app to extend their in-person efforts by giving students and young members a way to keep learning independently, wherever they are.

The Results

Early engagement has sparked impressive results.

______

The majority of users fall in the 13–25 age range, their core target for future member growth.

______

Positive member feedback via app comments highlights Zogo’s ease of use and engaging content.

______

The platform continues to be a consistent draw at youth-facing events.

Zogo’s gamification is becoming a core part of how Educators connects with the next generation.

What’s Next

Educators Credit Union sees even more potential ahead. They’re looking forward to deeper reporting capabilities and new ways to leverage user insights (spoiler alert - new features coming in Q4 2025). But what excites them most is the continued collaboration - they describe Zogo as a true partner that listens, evolves, and grows with them.